Staking

For more information on this category see: Mina Staking Process

How to stake Mina?

In Proof-of-Stake blockchains you can make a profit by staking, i.e. locking up your funds for a period of time. In this case the blockchain pays you reward just for holding the funds in stake. The amount of reward depends on the share of your stake in the total pool of stake. Literally, the more you stake, the more rewards you earn.

In many PoS blockchains, you can’t use staked, or locked funds. In Mina, your staked funds remain on the account and never leave the ledger. You stake or delegate all the balance, and you can use it in transactions. So it’s possible to withdraw your funds no matter if they are staked or delegated.

When staking, the right to create a new block is distributed randomly according to the Consensus algorithm. However, the higher stake a validator has, the greater the chance of winning the right to produce a new block is. When a person who has Mina funds delegates his or her crypto assets to a validator, it increases the chance of the validator’s winning a reward and, on the other hand, allows a delegator to benefit from staking. For more information about staking and delegation please go to Transaction and Delegation Statuses and Delegation Mechanism in the Mina Blockchain.

All in all, staking in Mina can run in the following ways:

- You can be a validator and stake Mina yourself (if you have enough balance to produce awards).

- You can install a node and delegate tokens yourself from the node to any validator (staking provider)

- see Validator Leaderboard

- see a guide on choosing a validator

- see a guide on how to stake Mina from a node by delegation

- You can stake Mina on a centralized platform.

- You can delegate Mina to a validator from a public Web/Mobile Wallet How to stake Mina

- You can delegate Mina to a validator with a Hard Wallet

See also: https://docs.minaprotocol.com/en/using-mina/staking – official Mina guide

How to buy Mina?

- see the guide How to buy Mina

What is the current APY we can expect from delegating Mina?

Any investor wants to know how much he or she will earn from the investment within a certain period of time. For convenience this period is usually a year. Annual percentage yield (APY) is the annual interest rate when applying the compound interest strategy. In other words, how much profit as a percentage of the initial deposit you will gain in a year using the compound interest strategy. If we compare it to banking, it’s like a yearly deposit interest rate.

Mina is an inflationary currency with no supply restrictions. All token holders stake or delegate to receive their proportional share of reward, which is the backbone of the inflationary mechanism, and this does not require locking or bonding funds. In total, up to 1 billion Mina tokens were distributed at launch (excluding future block rewards), which will be fully unlocked over 8 years.

Can inflation be calculated?

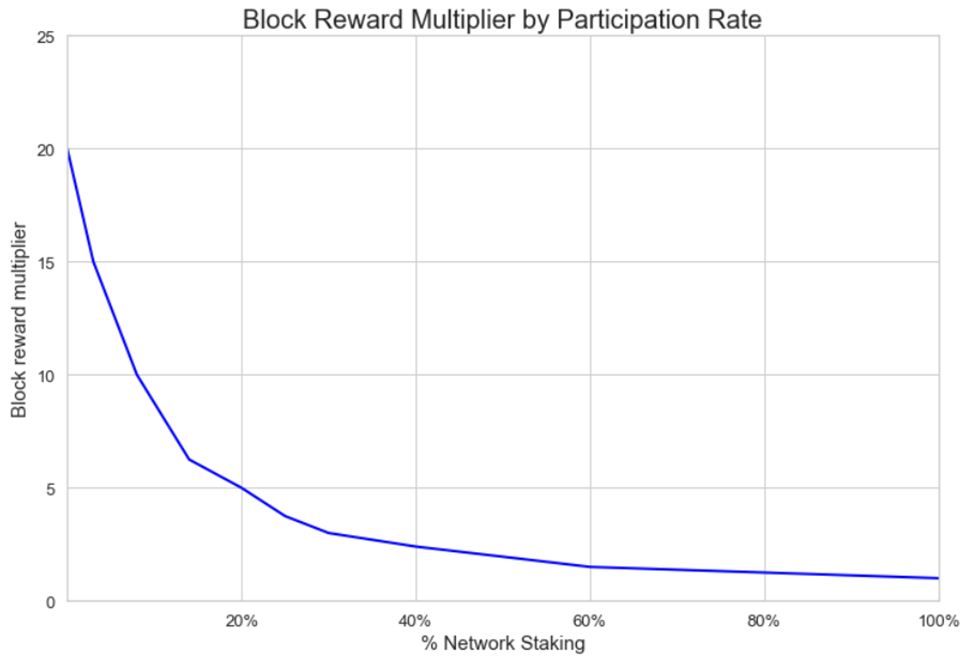

Mina is an inflationary blockchain. The supply of Mina funds grows steadily over time. During the first year of mainnet operation, locked accounts were rewarded per block to achieve an annual inflation rate of 12%. The inflation rate will decline over time, eventually reaching 7% at a steady state. Importantly, the protocol will target these inflation rates regardless of the staking participation rate. That means that block rewards will change dynamically to target this inflation rate. For example, if there are only 50% of the network stakes, then block rewards will double. This is because in Ouroboros (the consensus mechanism used in Mina), the number of blocks produced per epoch is expected to be proportional to the staking ratio. This naturally encourages more individuals to stake at lower participation rates.

Inflation, Token Emission and APY in the Mina Blockchain

How to earn supercharged rewards?

While regular rewards make up 720 Mina, supercharged rewards are double than that - 1440 Mina. To earn supercharged rewards, you need to meet the following requirements:

- Your validator must have enough supercharged stake to produce at least 1 block per epoch. To do this, your Unlocked Stake must be usually at least 150k Mina (this value may change over time).

- To check the Unlocked Stake amount of a validator go to the Validator Details;

- To check how a validator earns rewards and whether it produces supercharged blocks - go to the Reward Calculator.

- Your account must not contain locked tokens (all tokens must be unlocked). You can check if there are locked tokens on your account by going to the Account Details.

If your account contains part of the locked tokens, you can create another account and transfer the unlocked tokens to it. By delegating unlocked tokens from such an account, you can earn more by receiving supercharged rewards.

For more information on locked and unlocked accounts please go here

When does a delegation become active?

It normally takes 1-2 epochs until a delegation becomes active and starts to produce rewards. It depends largely on when you made your delegation: if you made your delegation at the beginning of an epoch, this extends the waiting time up to 4 weeks, and if you did it at the end of an epoch, it will take less time - normally up to 2 weeks.

See also Account staking page on your account in Explorer. See example here: Account Staking Page

When will a delegation produce rewards?

After a delegation becomes active it takes 1 more epoch until the now active delegation starts producing rewards and the blockchain distributes rewards to a validator for each block it wins. Then the validator will distribute the rewards to the delegators based on its terms. The Mina blockchain doesn’t regulate the validator-delegator relationship. Each validator sets its own reward payment terms and methods (see Validator Terms).

When will I get my rewards?

It takes some time for a validator to distribute to you as a delegator your part of the rewards.

In Mina, rewards are distributed to validators automatically, but sending rewards from validators to delegators is not automated and it’s the responsibility of validators (staking providers). From the moment when a delegation became active, it already produces rewards. Each validator has its own payout schedule. Most validators pay rewards at the end of an epoch. However, some may pay at the very beginning of the next epoch - check the website of the validator you’ve delegated to / ask the validator you selected to provide you with more details.

See Validator Terms page: Validator Payout Terms

Is the reward distribution process trustless?

No, in Mina the relationships between delegators and validators are not regulated by the blockchain. That’s why trust to a validator is an important element of the process. Be careful when choosing a validator.

We have very reputable staking services on our network with millions of MINA delegated to them and there have been no scurity issues so far. Anyway, it’s always best to do your own research (DYOR) first and go with someone that looks reputable in your eyes.

How to choose a validator?

Choosing a validator is a very responsible action since it defines how much reward you may earn. Here are the most critical things you have to focus on when you choose a validator to entrust your delegation:

Validator stake. In Proof-of-Stake blockchains higher chances of producing blocks are directly associated with the stake. So first thing you do is see how many tokens a validator has staked and what share it takes in the total stake in the blockchain. High stakes bring regular rewards. You can see the list of top validators here.

Validator fee. Every validator charges a fee from its delegators for staking services. Sometimes it can be 0, but normally a validator fee ranges from 1 to 10% or sometimes higher. Naturally, the higher a validator fee is, the less rewards you’re likely to get. However, top validators tend to charge higher fees. You can see the list of top validators here.

Payout frequency. Some validators pay rewards once or twice a month, some - even less regularly. To find out the terms of your validator, go to Validator Payout Terms.

Trustworthiness. It is important to carefully choose your validator, with whom you will entrust your funds. Theoretically, there are cases when a validator behaves dishonestly, appropriates all the rewards and does not pay to its delegator. Sure, it will ruin its reputation, but you will lose your rewards. In the dashboard Validator Leaderboard the “Verified” status indicates that this validator has confirmed the ownership of the specified address.

Overall validator performance. If you want to figure out what rewards you can win with each validator, use our reward calculator. Remember, however, that the calculation result is not a forecast, but rather a benchmarking tool that generates data based on the validators actual performance. It is necessary to note the possibilities of a validator regarding the potential profit. Not all validators can generate high income.

Does the total number of delegations to a validator matter?

The number of delegators is a minor feature, but it hints at some public interest in this validator, which can be caused by one or more factors at the same time:

- active marketing efforts or a strategy to attract public delegators;

- favorable conditions for delegators;

- the activity of validator representatives in communication with delegators;

- high trust within the community.

All in all, a high number of delegations is not a performance indicator as such, since it can’t affect your possible rewards in any way. However, it’s a positive cue telling that this validator is respectable and trustworthy.

Does the staking amount of a validator matter?

Validator stake is crucial for answering the question of whether it will produce blocks, and, accordingly, awards, so yes, it does matter. You can use our Validator Leaderboard to see the top validators in Mina in terms of their stake. However, it’s critical to keep in mind that a validator may produce both regular and supercharged blocks.

How to choose a validator with the highest reward?

Unlike in other POS protocols, where you can calculate the expected rewards in the staking rewards calculator, this is definitely not possible in Mina.

At the same time, there are factors that affect the chance of getting higher rewards. Below is a list of factors in descending order of importance:

- No (or fewer) missing blocks by a validator;

- Stable production of supercharged blocks by the validator;

- Lower validator fees.

You can learn more about the process of accruing rewards on the post-factum reward calculator here. Generally, the algorithm of analysis shall look as follows:

- select any epoch of analysis (preferably the last completed one);

- evaluate the performance of the validator;

- You can use the guide to сalculate your profits here.

How can I benchmark validator performance?

For this purpose, there is a special tool - Validator Rewards Calculator. This calculator computes post-factum rather than forecast rewards since Mina uses a highly randomized algorithm for producing rewards. On this dashboard you can see and compare the real historical validator performance data.

For more details on how the calculator works see the Rewards Page Reference.

It’s critical to understand, that the data of the selected epoch may seriously differ from the mean validator performance indicators, so make sure you make a more balanced assessment before you make a final decision. Validator Leaderboard can also give you a valuable insight into the validator performance.

How do I know if a validator is able to regularly produce supercharged rewards?

To do this you need to understand the Unlocked Balance of this validator is sufficient for the production of supercharges. At this moment to ensure a stable production of supercharged rewards you need about 150,000 Mina unlocked tokens. You can view this parameter as follows:

- go to the explorer on your validator's page;

- on the Validator Details tab, find the Unlocked Balance parameter in the Time Locks: Timelocks.

For more information on locked an unlocked accounts please go here.

When I delegate Mina do I have to move it to another account?

Mina funds that you have, never leave your wallet when delegating so you can do anything with it at any time and there is no need to move to a different address first.

At the same time, if an account has locked tokens, it will not be able to earn high rewards (supercharged rewards). In this case, it makes sense to move unlocked tokens to a separate account containing only unlocked tokens. Then you will be able to delegate your tokens to the validator from such an account and have a chance to get Supercharged Rewards.

If I delegate from address X and then move more coins to address Y do I have to resubmit the delegation for address X?

No, it's always the full balance delegated. It just takes a while for the balance to become active (the current epoch staking ledger is the snarked ledger of the last block of the current epoch - 2). In fact, technically, you can’t undelegate your funds in Mina. Once you delegate, all your balance is delegated, and your delegation amount changes along with your balance. You can choose the validator you’re delegating to, but the balance on your account will stay delegated for good. You can learn more about the delegation mechanism in Mina here.

How to redelegate my tokens in the next epoch?

Once you made a delegation your next epoch delegation will be performed automatically. Technically, you can’t redelegate your tokens, but you can change the validator you’re delegating to at any time, however, you’ll have to wait until the end of the current epoch for the change to come into effect. It is also important to understand that with the delegation at the end of the epoch, the account balance is fixed. Actually, you can delegate to the same validator again.

Can I use delegated tokens for transactions?

Your tokens are never locked at delegation. All that happens is a snapshot of the balance at the end of the epoch, which will count as the delegation amount. Therefore, you are free to use your funds as you wish. Meanwhile, you should understand that at the time of the snapshot, a smaller amount will be taken into account if you withdraw funds to a different address. At any time given all the funds on your balance are delegated, and the delegation amount changes along with your balance.

Can I undelegate my tokens?

No, there is no such possibility in Mina. This decision was taken because of inflation. That means when you delegate your tokens you will automatically receive every epoch rewards, which will erase inflation. However, you can delegate to another validator or to the same validator again at any time. To learn more about staking and delegations, go here.

Is it possible to delegate to yourself?

If you are a validator, then you can delegate to yourself. This makes sense if you care for safety since with a delegation crypto assets remain in your wallet. Moreover, a validator to whom more people delegated their funds can be considered more reliable among other validators.

Are supercharged rewards only paid to fully unlocked token holders?

Yes. You can also set a separate fee for supercharged and regular rewards. Remember that you get supercharged rewards only for the amount of unlocked Mina on your account, for the locked Mina funds you get only regular rewards.